Food and agriculture work is necessary for human survival. While a lot of things may change, investing in the food sector can yield significant returns and knowing where to focus your investments under ‘food and agriculture’ can provide long-term stability in your portfolio.

There are many business investment opportunities in the food industry, as long as you know how to invest wisely. Here are the thirteen best tips on how to invest in food industry:

1. Supply Chain Necessities

Learning about the supply chain necessities is important for how to invest in the food industry. The food industry is a sector complete with established brands, new tech, high competition, newcomers, and more.

The most stable investments are those that, without them, a supply chain and distribution network wouldn’t work. Consider the different stakeholders involved in creating food, transporting it, and putting it on your plate.

2. Food Processing

Once harvested, foods like wheat, corn, soy, and oats need to go through processing. The most successful players in food processing have strong revenue growth and excellent margins.

Unfortunately, it does cost a lot to collect, transport, and process raw foods. The bigger names often carry with them more customers, more shared costs, and therefore more value for an investor.

3. Food Chemicals

Producers of food rely on chemicals – from seeds to fertilizers, pesticides, and insecticides – to manage pests and yield nutrient-dense product. From genetically-engineered seeds and chemicals that ward off specific pests, there are a lot of corporations on which one can place their bets.

With that said, predicting pest management trends and with new patents arising every passing year, the category of food chemicals is in a permanent state of change.

4. Food Producers

Food producers comprise of key brands we see in grocery stores everywhere – Kraft, Oreo, Ritz, Trident, Lean Cuisine, and more. The biggest names in the food producer space are conglomerates that buy up smaller and fast-growing popular brands, bringing them under the corporate umbrella and distributing them according to demand. One can either look at these conglomerates for investment or at fast-growing to-be-acquired smaller brands.

5. Alt-Protein, Plant-Based Meals

Led by the vegetarian and vegan movement, more plant-based protein products have hit grocery store shelves and caused some major changes in the food industry. There’s been a lot said about investing in brands like Beyond Meat. Though the future remains unclear on which brand will become the leader, the fight in garnering market share right now is prime opportunity.

6. Distribution and Transportation

It takes a lot to build out a network. A distribution and transportation company can provide a stable investment, with potential growth for up-and-coming players. The metrics to concern yourself with are case volume and industry inflation. Examine how companies are building their networks. Though there’s high competition from national names and Amazon.com, food distribution networks at a regional level have their advantages.

7. Supermarkets

Supermarkets and grocery stores can make for very stable investments due to the diversity and adaptability of their inventory. They aren’t merely just places offering grocery shopping. Supermarkets often offer general merchandise, health and beauty products, fuel, pharmacy, apparel, and quick-service prepared food. In the past year, supermarket brands netted the biggest returns of any food industry investments.

8. Sub-Industries to Remember

Sub-industries in the food industry may not always be flashy but in them are places to put your money and retain them in stable investments. Areas like farms, farming machinery, food processing, food producers, distribution, grocery stores, restaurants, and delivery services all include various companies that are either established or growing.

9. Farm Machinery

Established brands in farm machinery are high-value with a network of distributors and regular revenues. In years where the value of crops like corn and grain have gone up, farmers upgrade their farming equipment. In periods of uncertainty though, those same purchases see a delay. Knowing how to move around your investments in and out from this area requires skill and familiarity with what’s expected across a growing season.

10. Sustainability Trends

In an effort to make food and agriculture more climate-friendly, a lot of corporations want increasingly sustainable processes and materials. At the production, supply chain, and consumption stages, there exists a number of opportunities for new tech and products to disrupt the industry and provide major short-term gains.

11. Health Foods

Health foods are a high-competition food industry sector. They don’t make for the smartest investment because there are so many companies vying for the market. That said, some companies experience amazing growth year-over-year and the attractiveness of betting on a winner can mean looking here for your next big return. Calorie-burning beverages, low-calorie foods, and different types of protein-based food products have all proven popular.

12. Corporate-Funded Food Suppliers

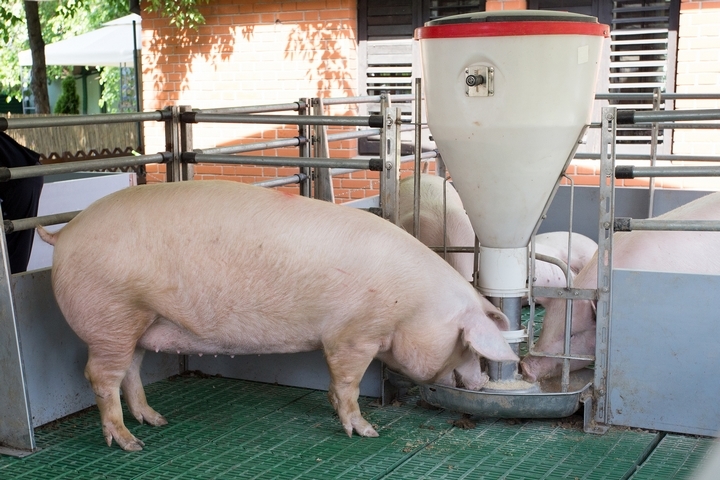

From fast food chains to restaurants and grocery stores, brands rely on family-run farm and corporate farms for supplies. Although family-run operations are small and unavailable for investment, there are larger corporations that own and/or buy farms for specific use such as growing grain, peas, corn, and cattle ranching. As tech continues to make these farms more efficient, their value increases and so does your investment.

13. AI and Food Industry Robotics

Automation is going to change virtually every industry on Earth within the next century. In commercial kitchens and fast food, AI and robotics are already having a field day. AI robot licensing to some of the world’s biggest food companies can turn a near-zero to a hero immediately. Placing your bets on the right company today could net a high increase in investment value.